Pakistan is truly shifting towards policies that encourage investment in the country! FBR is making it easier for overseas Pakistanis to invest in real estate back home. This new policy is expected to facilitate the investors especially those living abroad in the process of buying a home.

You no longer have to worry about high taxes, all thanks to the Federal Board of Revenue (FBR). They have recently announced a tax exemption for overseas Pakistanis, which significantly lowers the cost of buying property in this nation.

We at One Homes are excited about this change! It allows investors to have an easy, safe, and rewarding investment journey. And, we are here, enabling your investment by developing modern, contemporary homes in your homeland. This is an investment that will pay for itself in the years to come.

New Tax Exemption for Overseas Pakistanis

The government is focused on attracting overseas investors. Hence, they have recently announced a tax exemption policy for overseas Pakistanis who are investing in real estate. The eligibility criteria for exemption is that people who hold a Pakistan Origin Card (POC) or a National ID Card for Overseas Pakistanis (NICOP) are exempted from taxation under Sections 236C and 236K of the Income Tax Ordinance, 2001.

Moreover, you no longer have to be on the Active Taxpayers List (ATL) in order to qualify for these exemptions.

A Streamlined Process with Digital Verification

The FBR has simplified the process by introducing a new digital verification system through IRIS. Non-resident Pakistanis only need to upload their POC or NICOP documents when creating their Computerized Payment Receipt (CPR). The system then generates a provisional PSID, kicking off a streamlined verification process.

To make things faster, the FBR has ensured that verification is completed within one business day. To keep you notified you will be sent SMS and emails.

Simplifying Real Estate Investment Like Never Before

The process of tax exemption is being implemented in all major tax offices such as Large Taxpayers' Offices (LTO), Medium Taxpayers' Offices (MTO), Corporate Tax Offices (CTO) and Regional Tax Offices (RTO). Real estate investing has never been easier with reduced red tape and faster processing timelines in Pakistan.

With One Homes, you can skip the stress of tax filing and balloting. We’ve made the process simple and hassle-free so that you can own your dream home without any complications.

Your Investment, Your Future—Simplified

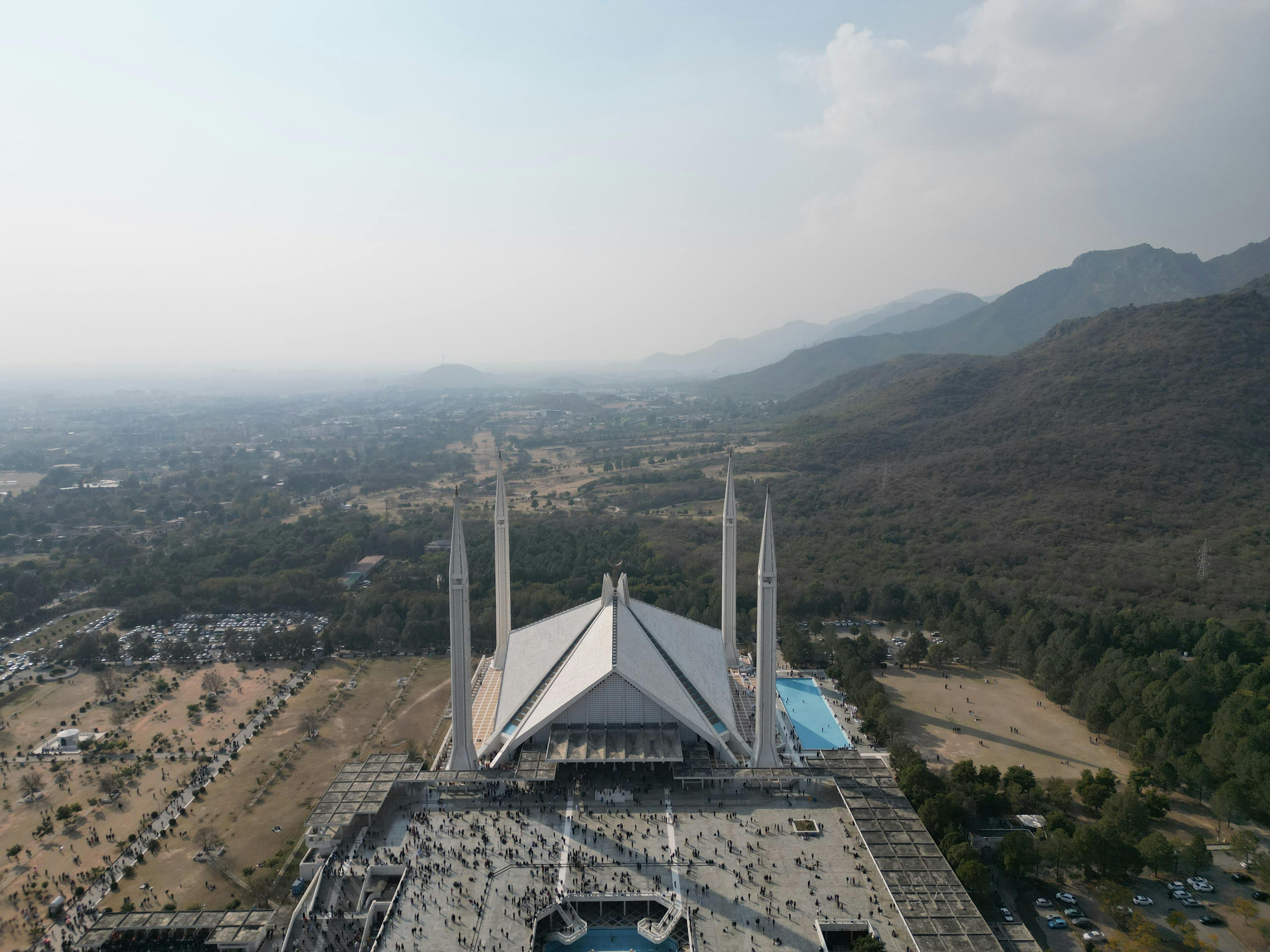

Whether it’s the stunning views from One Canal Road in Lahore or the lush green surroundings of One Serene Residences in Islamabad, we’re here to help you build a home you’ll be proud of.

With over $400 million invested in the real estate of Pakistan, we are enabling you to have a home that offers modern and community-focused living spaces. And, our aim to to deliver something that goes beyond the standards you’re accustomed to in the West.

You can take the opportunity of this new tax exemption and start the process of buying a home in Pakistan. At One Homes, we are with you to help you throughout the process. Contact us now and we will make your dream home in your dream country, a modern, luxurious and permanent residence.

Recent News