The global real estate landscape is undergoing a transformation, with shared living spaces emerging as a dominant trend. Projected to grow into a $17.5 billion market by 2027, these spaces combine private living quarters with communal amenities, prioritising connection, affordability, and sustainability.

For overseas investors, this trend presents a unique opportunity to align with global preferences while tapping into high-return rental properties in dynamic markets.

What’s Driving the Rise of Shared Living Spaces?

Anyone with experience living in a community-centric space will have no trouble understanding why they’re catching on, but the trend goes beyond personal preferences. There are real, documented contributing factors that are driving young people to choose shared spaces in a post-pandemic world:

Social Connection

Shared living creates a strong sense of belonging, with 85% of residents reporting a deeper community bond than in traditional housing. From co-working spaces to shared lounges, these developments foster collaboration and friendships.

Sustainability

Community-centric housing reduces individual carbon footprints by up to 30% through resource-sharing and eco-friendly designs. This aligns with growing global efforts to combat climate change while enhancing the appeal of such properties for environmentally conscious investors.

Affordability

By offering amenities like gyms, coworking areas, and recreational spaces at 10-15% lower costs than traditional rentals, shared living provides cost-effective luxury in prime urban areas.

Why Shared Living Spaces Thrive in Emerging Markets

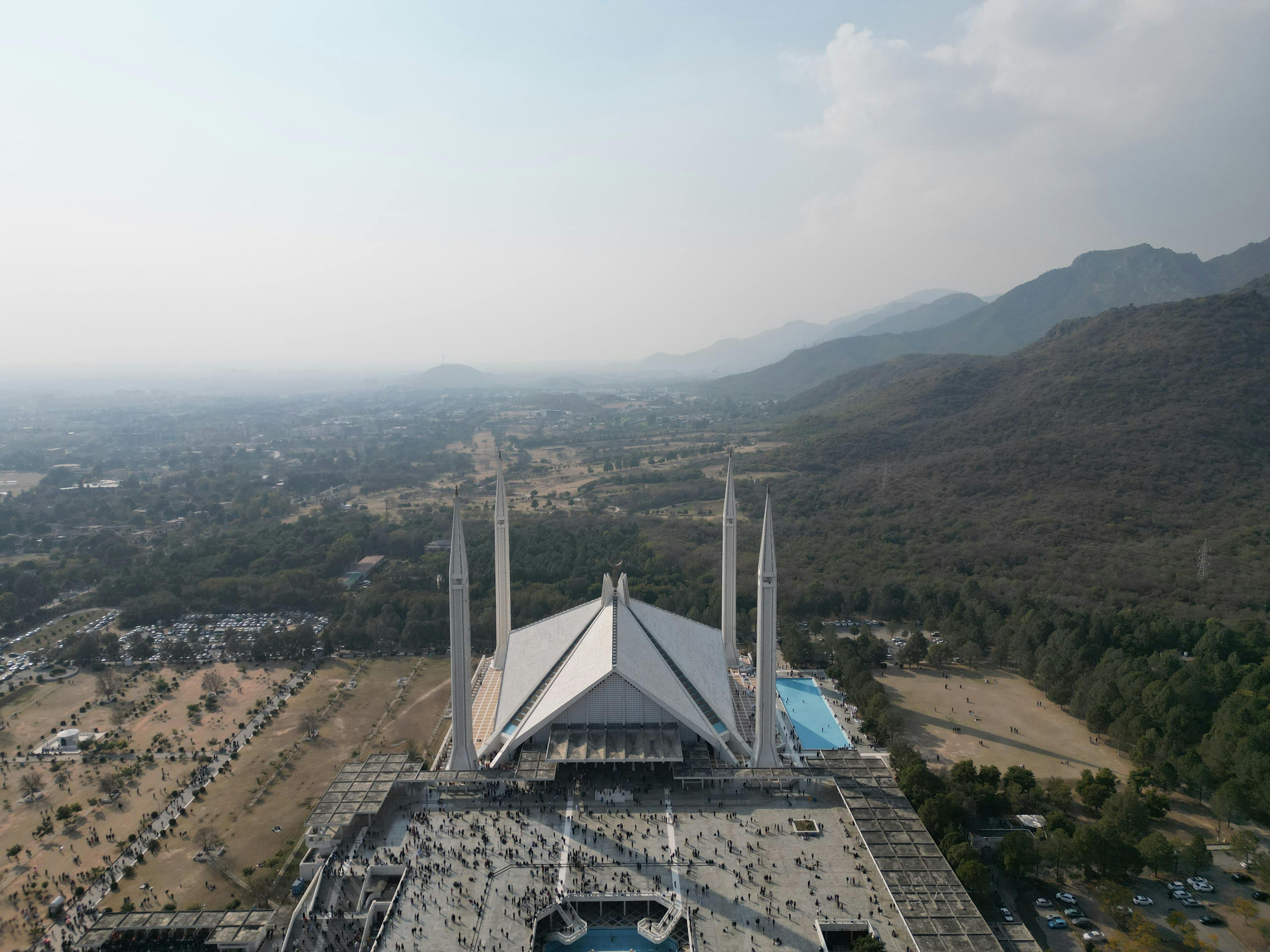

Emerging markets are uniquely positioned to embrace the shared living revolution. Pakistan, for example, offers a blend of cultural values and growing urbanization that makes community-centric developments particularly appealing.

Cultural Alignment: Shared living mirrors the extended family structures traditional in Pakistan, making these developments a natural fit.

Urban Demand: With Pakistan’s urban population projected to grow by 40% by 2030 (Savills report), cities like Lahore and Islamabad are ripe for innovative housing solutions that combine community and convenience.

A Future-Proof Investment Opportunity

Shared living spaces aren’t just a lifestyle choice—they’re a resilient investment. Properties in this sector consistently attract younger demographics who value affordability and community, ensuring steady rental demand.

In Pakistan, these spaces align with the nation’s rising middle class and urbanisation trends, offering investors opportunities to earn financial freedom through passive income in high-growth markets.

How To Invest

Shared living spaces represent the future of real estate, blending community, sustainability, and affordability. For overseas Pakistanis, they offer a way to reconnect with their roots while securing a profitable investment in an evolving housing market.

Build a legacy with One Homes. Our developments combine cultural authenticity with cutting-edge innovation, providing exclusive opportunities to invest in the future of real estate. Your journey starts here.

Recent News